Why SIMALTO Survives – Even If It Was Never Good Enough

SIMALTO shouldn’t still be here.

SIMALTO survives because no one gets fired for checking boxes.

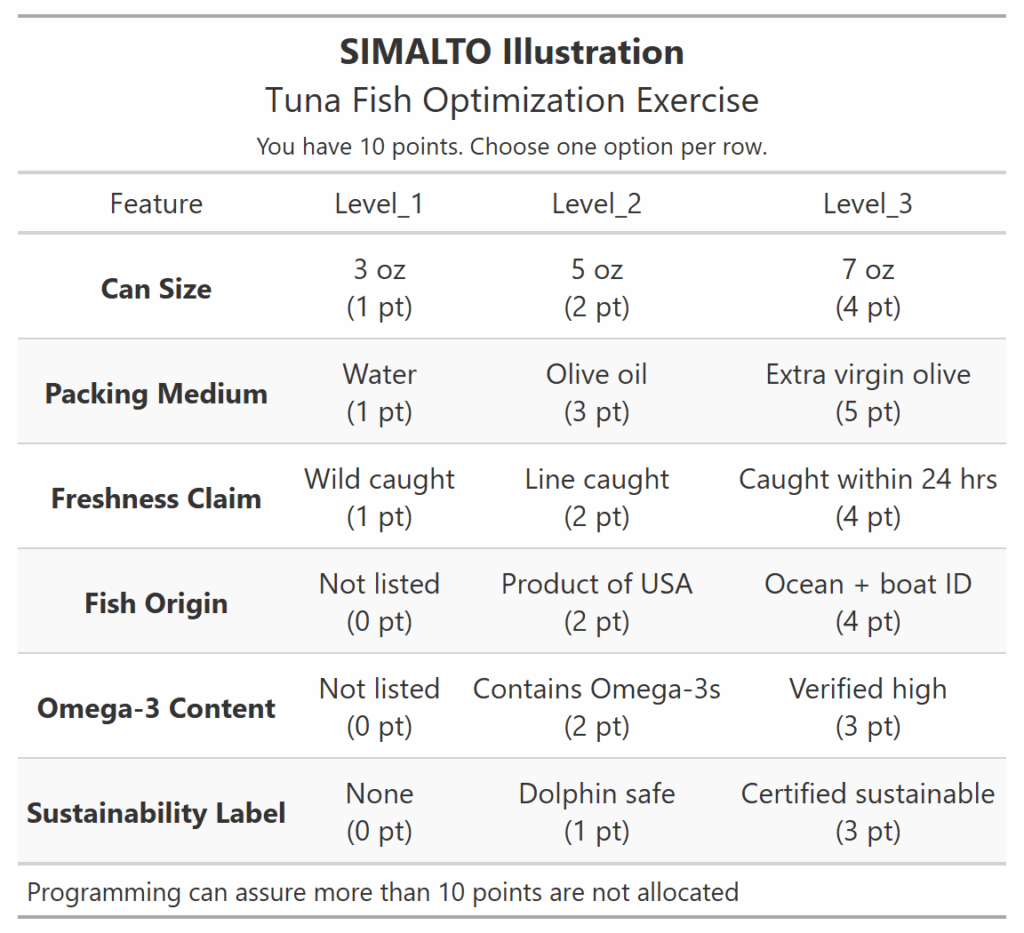

It forces trade-offs to behave like point totals—linear and tidy, when the real world isn’t. But it feels fair. It feels inclusive. And that’s why it’s still used.

In pricing and product optimization work, SIMALTO isn’t chosen for its accuracy—it’s chosen because it makes the room feel less tense. That’s the real function: easing discomfort. Not driving clarity.

Let’s talk about why that’s a problem.

The Illusion of Consensus

On paper, SIMALTO seems democratic.

Everyone gets their points. Everyone faces constraints. The resulting chart looks balanced. But what you’re really seeing is a performance of alignment—not alignment itself.

SIMALTO makes it easy for the data to look aligned—even if the decision team isn’t.

The moment you present the results, there’s a visible sigh of relief. “Okay, now we know.” But you don’t. You’ve just deferred the hard trade-offs.

SIMALTO was once considered a serious innovation in product optimization.

Here’s a now-dated academic defense: (Green, 1977)

It’s easy to see how it gained traction. But the real-world tension inside modern pricing decisions rarely fits this kind of structure anymore.

When Conflict Is Avoided, Clarity Is Lost

The biggest reason SIMALTO survives has nothing to do with analytics.

It’s the fact that most teams want to avoid the messy tension of real prioritization. And that’s what SIMALTO helps them do:

- It doesn’t force departments to debate margin vs brand equity

- It doesn’t surface the opportunity cost of one SKU over another

- It doesn’t ask who wins and who loses

That’s the problem.

Models that smooth over real stakes create the illusion of progress. But the next time the pricing team meets with marketing and finance, all the underlying tensions are still there.

They just weren’t in the survey. SIMALTO was built for exploration.

Not for understanding.

Why Revenue Crafting Doesn’t Stop at “Insight”

Revenue Crafting is designed to move through to the decision—not stop at insight.

That means building tension into the model on purpose, not smoothing it out. Not everyone gets equal weight. Not every feature gets to survive.

That’s what strategy demands.

If you’ve used tools like SIMALTO and still walked away with no clear pricing strategy, you’re not alone.

See the full review for a longer teardown.